In recent months, many questions have surfaced regarding new insurance initiatives in the Canadian market. This article is designed to provide a factual, comparative overview of vision care insurance in Canada and the United States. The intent is to equip Canadian optometrists with a deeper understanding of both the risks and the opportunities on the horizon.

“When you can’t control what’s happening, challenge yourself to control the way you respond to what’s happening. That’s where your power is.” — Unknown

The Dental Model: A Blueprint for Vision?

The dental profession in Canada has built a relationship with insurance providers that optometry envies and has yet to achieve. Nearly every employer-sponsored benefit plan includes dental coverage, driving regular visits and fair compensation for dentists. While optometry has attempted to follow a similar path for over 40 years—through associations, governments, and commercial initiatives—all efforts have failed. Why have these efforts failed? The optical industry is different than dentistry BUT the dental profession found ways to work together that optometry has not been able to replicate.

The Canadian Reality: Vision Care by the Numbers

- Insurance Coverage: Only 43% of Canadians report having vision care insurance. 52% do not, and the rest are unsure.

- Exam Avoidance:

- 29% avoid eye care due to cost.

- 24% skipped exams this year because insurance did not cover it.

- 8% avoid exams because they experience no symptoms.

- Long Gaps in Care:

- 1 in 4 Canadians who don’t wear glasses have not had an eye exam in over 10 years.

- 16% had their first eye exam after age 31.

- Average time between eye exams is 21–26 months.

- Utilization Patterns: Eye exams and eyewear purchases are significantly higher among those with Vision insurance.

Despite high-quality optometric care, Canada sees among the lowest eye exam rates in the developed world. Is more insurance coverage the solution?

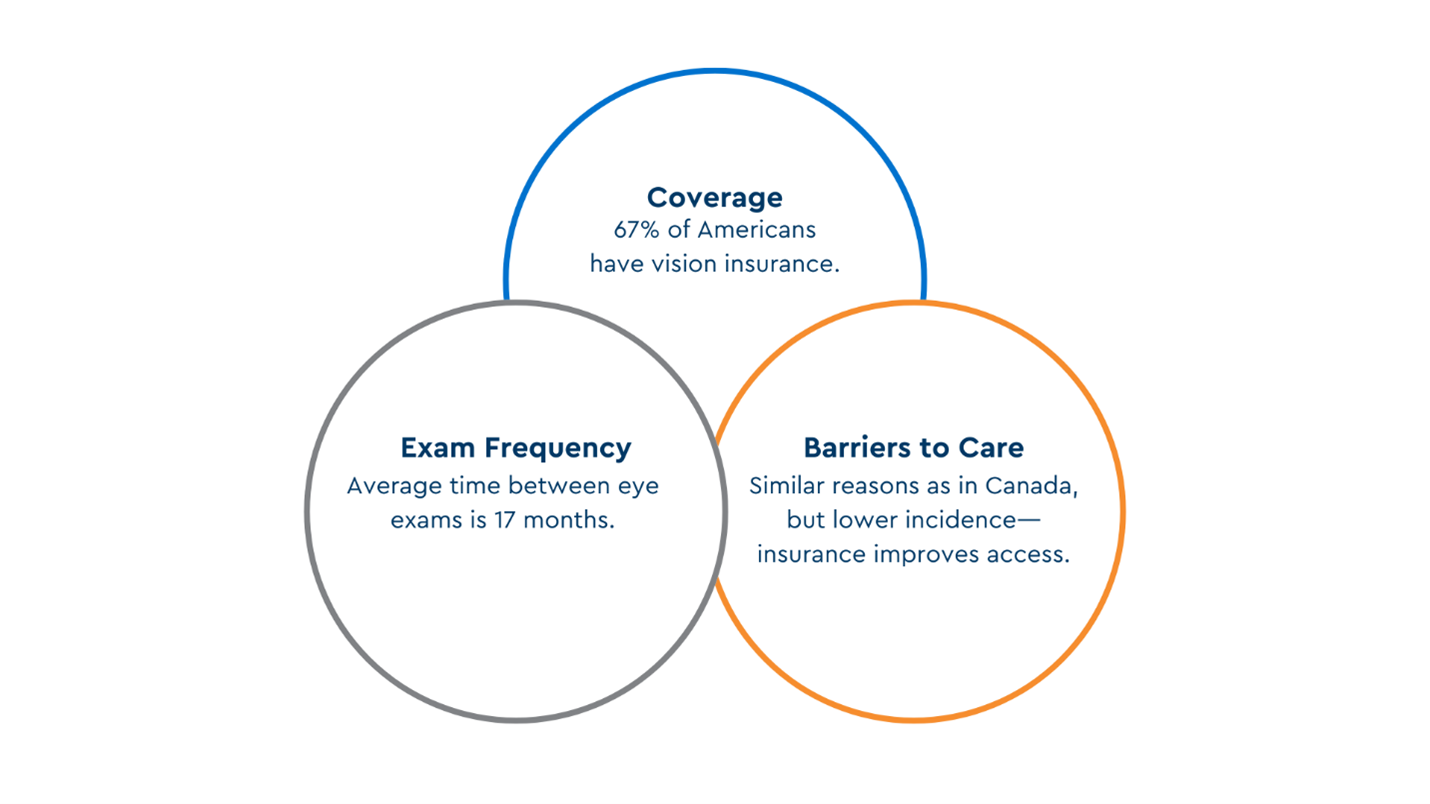

The U.S. Model: A Managed Care Machine

The U.S. vision care insurance model is vastly different. Coverage is broader, integration with employers is deeper, and overall health managed care dominates the landscape.

VSP: The Origin Story

Vision Service Plan (VSP) was founded in 1955 by California optometrists to fill empty appointment books. VSP remains a not-for-profit entity and is now the largest vision insurer in the U.S. It pioneered the “network model”—a foundational concept in understanding American vision insurance.

Managed Care and PPOs: How It Works

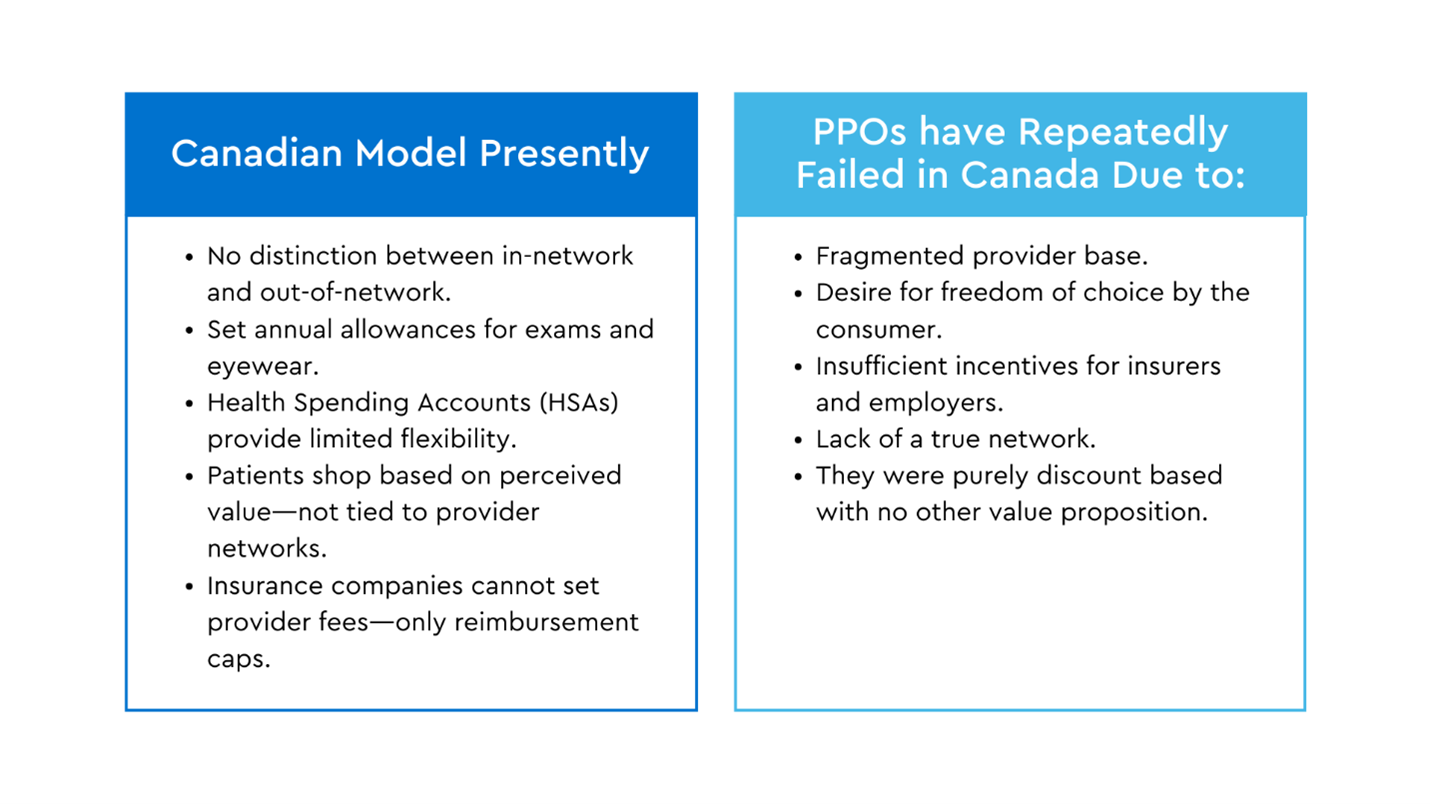

In the U.S., vision plans operate on Preferred Provider Organization (PPO) models. Patients can either choose an in-network or out of network provider.

- In-Network Providers: Better benefit, direct claim processing, and higher coverage levels. A very convenient option for patients that lowers their costs and provides maximum benefit.

- Out-of-Network Providers: Higher cost to patient, lower level of coverage, and no direct claims processing.

In reality, the vast majority of patients stay in network.

PPOs benefit employers with:

- Lower premiums

- Simplified administration

- Greater perceived value

However, for optometrist providers, it comes at a cost:

- Fees are dictated by insurers

- Product usage may be mandated

- Reimbursements are often below fair market value

Still, most optometrists join these networks out of necessity—the networks drive patient volume.

“The system you are part of will shape your destiny unless you decide to shape it first.”

Why PPOs Thrive in the U.S.—and Fail in Canada

In the U.S., insurers build massive networks that they “sell” to employers. In contrast, Canada lacks the infrastructure, network size, and centralized coordination to make PPOs viable.

Additionally, brokers often misunderstand and have an ignorance of the value of vision care, making it harder to sell.

Emerging Risks: The Tipping Point

The Canadian market is at a crossroads. Large multinational retailers, having succeeded in insurance-driven environments elsewhere in the world, are approaching Canadian insurers with enticing proposals. Insurers are listening.

Risks include:

- Vertical integration: Insurers may buy or build networks, dictating terms to optometrists.

- Lack of leadership: Associations, buying groups, and commercial efforts have not coordinated effectively.

- Consolidation pressure: With little unity in the profession, outside forces may reshape optometry.

“If you don’t like change, you’ll like irrelevance even less.” — Gen. Eric Shinseki

The Opportunity: Rewriting the Narrative

Amid the challenges lies a powerful opportunity to redefine how vision care is valued by insurers and employers.

Key talking points for advocacy:

- Optometrists are the first to detect diabetes 33% of the time and hypertension over 50% of the time in early stages (U.S. insurance data).

- Vision care plans can generate a 15:1 return on investment through improved employee productivity (Versant Health, USA).

- Eye care is increasingly seen as a pillar of preventive health, not just a corrective service.

We must push for broader coverage including:

- Dry eye therapy

- Low vision services

- Vision therapy

- Myopia control

If we tell our story—effectively and collaboratively—we have the chance to influence policy, funding, and benefit design.

“The best way to predict the future is to create it.” — Peter Drucker

Conclusion: Time to Choose Our Future

Canadian optometrists are at a pivotal moment. Will we innovate or observe? Take control or wait to be controlled?

Whatever path we choose, the profession must:

- Protect its autonomy

- Educate insurers and brokers

- Build scale through collaboration

- Advocate for full-scope care

Final Thoughts: A Call to Action

Every model—whether Canadian or American—comes with its own set of pros and cons.

- The U.S. managed care system delivers broader access and stronger insurer relationships, but often at the expense of professional autonomy and fair compensation.

- The Canadian model offers freedom and flexibility but lacks cohesion, coverage, and consistency.

Canada stands at a rare crossroads. We are not burdened by legacy structures, but that freedom is fragile.

We have a unique opportunity to tell our story—one that emphasizes how optometrists are not just vision correctors, but frontline providers in chronic disease detection, early intervention, and preventive care.

“People don’t buy what you do; they buy why you do it.” — Simon Sinek

If we do not take control of this narrative—if we allow vision care to remain simply an “allowance”—we risk losing the opportunity to:

- Differentiate ourselves from retail and online providers

- Demonstrate the full scope and impact of our care

- Attract the attention of employers looking to invest in real wellness outcomes

Optometry is ready to lead in healthcare. But first, we must speak with one voice, educate with clarity, and advocate with purpose.

Because if we don’t define our value, someone else will—and it may not serve our patients, our profession, or our future.

This is a sponsored post.

Alan Ulsifer, OD

Chair and CEO FYidoctors

Dr. Ulsifer graduated from the University of Waterloo as an optometrist in 1990, where he was acknowledged for several awards in clinical achievement, including the Ontario Association of Optometrists Award for Excellence in Patient Management.

After graduating, Dr. Ulsifer became one of the founders and the managing partner of Northern Vision Centre, which developed into one of Canada’s largest independent optometric practices. Dr. Ulsifer has also been involved at the executive level with various not for profit Boards including: Alberta Optometric Association, Rotary, Optometry Giving Sight, the Alberta Freestyle Ski Association and the Grande Prairie Chamber of Commerce.

In 2008, Dr. Ulsifer oversaw the creation of FYidoctors, which still stands as the largest business merger in Canadian history in terms of the number of companies involved. He was awarded the Ernst and Young Emerging Entrepreneur Award for Western Canada in 2008 and the Top Canadian Entrepreneur Award in 2012. Dr. Alan Ulsifer has served on many Boards over the years and has an ICD.D designation. He currently serves as CEO & Chair of the FYihealth Group and a board member of Dermapure, the worlds largest medical aesthetics consolidator which he was key in forming.