You will recall last month’s article, Adulting 101: Part 1, a two-part article series that covered setting up your life and career. In this installment, we’re going to review understanding your money and provide a brief recap of your next steps.

Part 2: Understanding your Money

Money, Money,—Money Money!

Cash in, cash out, taxes, saving for short term goals AND retirement, and debt repayment. Working with an advisor to lay out your cash flow planning will ensure that you don’t lose sight of your priorities as you head out into the grown-up world.

Shiny new cars can easily draw your attention away from debt repayment. An advisor can help keep your hands out of the cookie jar and keep you focused on building your wealth.

An accountant will be critical in assisting you with the myriad of tax deductions and credits you will want to apply to lower your income and manage your tax bill.

Your financial advisor will help you plan in advance so that you can structure your income and expenses to maximize your “in pocket” cash. Both professionals are needed and should work for you as a team.

Debt

All debt is bad, but some debt is actually better than other debt and the order in which you repay your debts does matter. It is key to always repay your worst debt first – that dreaded credit card debt. It is consumer debt that costs you a lot in interest and you really have nothing from those purchases that builds up your net worth.

You are Your Greatest Asset

As you start your career, your ability to earn an income is your greatest financial asset. You will need to protect this asset. This means you will need insurance.

Insurance that protects your butt at work (malpractice insurance), insurance that protects you in the event of a liability at home or on the road and disability income replacement insurance.

You are the goose that lays the golden egg, so before you insure the value of that egg, we should discuss your needs and solutions for coverage and review the various student plan options available to final year students and new graduates.

Taxes!

Yes, as you use up your education tax deductions you will find yourself with a tax bill. Often you will be a self-employed contractor and as a result, no one will be deducting and submitting tax payments on your behalf. It will take up to two years of tax filings before the government mandates that you make tax installment payments. Which, BTW, is also not likely to be sufficient as your income grows.

So, to prevent any surprises come tax time, the best rule of thumb is to put 25% of all the income you earn (less tax installments made) into a “don’t touch” savings account.

Come the first part of the year, working with your financial advisor, you can determine a rough estimate of your taxes due and if RRSP contributions are a prudent decision for you. RRSP contributions will lower your overall tax bill but are not always the right fit based on your goals. So having that conversation in the first 30 days of the new year will help ensure that any contributions, if so warranted, are done before the 60 day deadline.

The Canadian tax system is complicated – so having experienced advisors will be key to navigating this new world where you will also want to keep receipts of various business related expenses to legally lower that bill.

Adulting is Hard

We covered a lot of ground in these presentations, including some discussion on the difference between employee and independent contractor. CPP contributions and EI premiums. T2125 forms and putting cash away for your tax bill. We touched on income variations across the country for new ODs and living expenses in a few locations. There are a lot of decisions to be made!

Easy as Pie (if pie were easy!)

- Be clear on your goals & desired lifestyle – download the workbook and invest the time to really review who you are and what is important to you.

- Align yourself with a trusted advisor – someone who understands you, your profession and your needs – now and over the many stages of your life.

- Protect your ability to earn an income because you are your greatest asset.

- Understand all contracts before you sign.

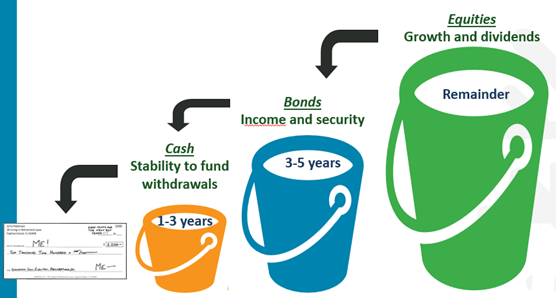

- Work with your advisor to create a cash flow plan that allows you to enjoy your new earned riches, build wealth, AND repay your debt.

- Understand tax mitigation and pay your taxes.

Related Read:

This is a two-part post. Refer back to Part 1.

Advisory

As your Chief Financial Officer, I am here to help guide you through the various adult decisions you will need to make and the next steps you will be taking. Helping you understand your money and assisting you in making smart financial decisions about your debt repayment, insurance protection, tax management and wealth creation, are just some of the ways that I work as your fiduciary.

Have more questions than answers? Educating you is just one piece of being your personal CFO that we do. Call (780-261-3098) or email (Roxanne@C3wealthadvisors.ca) today to set up your next conversation with us.

Roxanne Arnal is a former Optometrist, Professional Corporation President, and practice owner. Today she is on a mission of Empowering You & Your Wealth with Clarity, Confidence & Control.

These articles are for information purposes only and are not a replacement for personal financial planning. Everyone’s circumstances and needs are different. Errors and Omissions exempt.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.