Roxanne Arnal, Optometrist and Certified Financial Planner© has made her article available in audio format.

Click the play button below to listen.

Dr. Roxanne Arnal, CFP®

The age-old question for corporation owners. Do I take salary or dividends?

First off, congratulations – you are earning enough money in your corporation to pay yourself! If you started your business cold, this is a day to celebrate. If you are fortunate enough to have sufficient profits to support your lifestyle, you are now asking one of the most common tax questions.

And the answer…it depends.

RRSP Contribution Room

The tax deferral benefit of a Registered Retirement Savings Plan is greatest when you expect to be in a lower tax bracket in retirement than the one you are currently in. This isn’t an easy calculation, because you also have to remember that retirement income is not all taxable, and actually, some forms of retirement income can have a greater negative effect than others [think Old Age Security (OAS) Clawback]. And, we really don’t know what the tax rates will be like in the future.

In order to deposit to an RRSP and defer taxation, you need to create RRSP contribution room. RRSP contribution room is created through earned income. Dividends and capital gain sources of revenue are NOT earned income and therefore do not create RRSP contribution room.

There is also an annual cap on the amount of new contribution room you can create in any one year. For 2021, this cap is $27,830, which corresponds to earned income of $154,611.

If you take dividends however, you will not create any RRSP contribution room. And, for good tax and retirement planning, I don’t recommend an all or nothing strategy for any client.

CPP Contributions

The Canada Pension Plan forms part of the basic framework of the Canadian retiree social system. It is designed, along with OAS, to provide Seniors with a base living allowance. I typically use this base as the safety net for my retirees. Everyone, even my super high net worth clients, like having a safety net.

CPP won’t likely make up a large part of your retirement income, but the program also has disability benefits that kick in for those that suffer severe and long-term disabilities preventing gainful employment. An additional top up to your personal income replacement plan.

Salaried income is subject to CPP contributions. For self-employed individuals, you are essentially paying both the employer and employee portions. For 2021, this rate is 5.45% for each side, for a total of 9.9%. I know this sounds like a nearly 10% additional tax hit, but there is a cap on this amount. For salary earned above $61,600, no further CPP contributions are required. Hence, for a salary at the RRSP contribution maximum, CPP accounts for just over 4%.

Ideal Split

In all reality, most clients benefit from a split between salary and dividend income from their corporations. Finding the right balance between excess lifestyle withdrawals for additional investing vs corporate investing needs to be reviewed on an ongoing basis.

Where lifestyle needs exceed the after-tax income created from an RRSP contribution maximum, $154,611, then I always recommend you pull the excess as dividends.

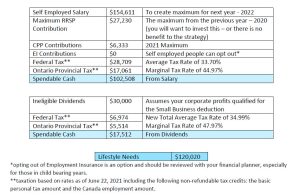

Let’s look at an example

Say you need $10,000 a month of spendable cash to cover off your mortgage, student loan payments, property taxes, utilities, groceries, and a little fun.

In Summary

There are several factors to consider on a salary or dividend split for those owning professional corporations. Part of it involves a conversation around your goals and retirement dreams. As a family CFO, I review all aspects of these decisions with my clients and work toward creating plans that meet your desires today and your dreams tomorrow.

This article should not be construed as personal financial advice.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.