Dr. Roxanne Arnal, CFP®

There is never a quick answer to this question. For today, let’s cover a few of the basic differences between personal and corporate investing.

Are there differences in the types of accounts a person and a corporation can own?

A person over the age 18 typically has access to three types of accounts:

- A registered retirement account (RRSP). In your saving years, the most common is an RRSP.

- Since 2009, we also have access to a Tax Free Savings Account (TFSA).

- Lastly, we have open accounts. These are also referred to as Cash Accounts or Non-Registered Accounts.

For further information on these accounts, please refer to my previous article: RRSP vs TFSA.

A corporation only has access to Open Accounts.

How do contribution dollars differ?

Investing in an RRSP is done with a pre-tax dollar and is a fully tax deferred account.

All other investments are done with an after tax dollar.

Personally, both the RRSP and TFSA account types have contribution maximums.

An Open Account, whether personal or corporate, is funded with after tax dollars and is not subject to any maximum contribution cap.

What is the difference between corporate and personal after tax dollars?

This is where things start to get interesting.

For our discussions, we are assuming that you are the sole owner of your Professional Corporation (PC) and that the dollars you are using to invest in your PC have been generated from Small Business Deduction paid tax dollars.

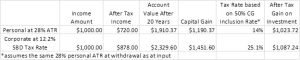

Let’s assume you live in Ontario and earn $155,000 of taxable employment income. This will place you at a combined federal and provincial marginal tax rate of 41.16% and an approximate average tax rate (ATR) of 28%.

The SBD corporate tax rate in Ontario is 3.2%, and the federal rate is 9.0%, for a combined tax rate of 12.2%.

Therefore, if you take $1,000 from your personal income, you will have $720 to invest. If you keep the $1,000 inside your corporation, you will have $878 to invest.

Why this matters?

Compound interest can be a beautiful thing. The more money you invest in a compounding investment, the more wealth you ultimately create.

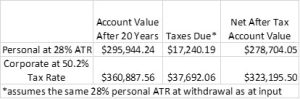

Assuming a 5% year over year rate of return, after 20 years with no additional deposits, the personal investment will have grown to $1,910.37 and the corporate investment will be worth $2,329.60. Of course, the tax story isn’t over yet.

On open accounts, all earnings are taxable, and because the Canadian Tax system is so simple (insert very obvious sarcasm), taxation on investment growth varies by the type of income received in that investment (which is of course related to the tax that the investment company has paid before paying you). That being said, interest, dividends, and capital gains are all currently taxed at different rates.

For today, let’s attempt to keep things simple by assuming that 100% of your investment growth is a capital gain and therefore the entire tax bill on the investment in our example won’t be triggered until it is sold in year 20.

The difference in the last column may not seem like much, but what if you took that $1,000 of income amount every month and invested it using the same assumptions over that entire 20 year period? After the 20 years of investing, you have input an additional $37,920 into the corporate investment and have grown your overall investment by nearly an additional $65,000 before taxes.

Now, keep in mind, the net after tax account value in the personal account is ready to spend, while the corporate account value is still locked in the corporation.

In order to get the corporate dollars to your personal bank, you will be subject to personal tax. For simplicity we will assume that you will remove the money from your corporate account as an eligible dividend over a ten year period of time. Using the current Ontario eligible dividend marginal tax rate (after gross up and dividend tax credits) for those with a taxable income of $150,000 at 25.38%, the $323,195 is now $241,168 of spendable cash, for a total spendable cash loss of $37,535.

So does that mean I shouldn’t invest in my corporation?

…Well not so fast! This example made several assumptions, including the massive assumption that the future tax rates will remain the same and that your taxable income in retirement will place you at the same tax rates that you are currently at. I didn’t pick a $155,000 annual employment income amount at random either. For 2021, you earn the maximum RRSP contribution limit of $27,830 when your employment income is above $154,611.

All of these factors matter when we build a holistic plan that involves multiple different accounts and wealth creation strategies to help insulate you from the unknowns of future tax rates and provide for multiple sources of income draw – some taxable and some not.

It is therefore critical that your financial planner review all pieces of your puzzle and strategies to set you up for a future that has considered multiple sources of retirement revenue, possible future tax changes, and estate priorities.

As your Chief Financial Officer, I’m here to help you ask the right questions. I help you manage a team of financial professionals and ensure that you have thought about the potential issues. The more we learn, the more we realize the need to learn more, and yes, another topic for another day!

Have more questions than answers? Educating you is just one piece of being your personal CFO that I offer. Call or email today to start your plan.

Roxanne Arnal is a former Optometrist, Professional Corporation President, and practice owner. Today she is on a mission to Empower your Finances.

These articles are for information purposes only and are not a replacement for personal financial planning. Everyone’s circumstances and needs are different. The values provided here are subject to change and should not be construed as fact. Tax rates illustrated were in effect as of January 1, 2021. Errors and Omissions exempt.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.