Roxanne Arnal, Optometrist and Certified Financial Planner© has made her article available in audio format.

Click the play button below to listen.

Dr. Roxanne Arnal, CFP®

Have you ever thought of it?

You’ve spent 6 or more years in post-secondary education. You may be riddled with student debt, you may have a mortgage, kids to feed, a business to run. But what truly is your greatest asset? Let’s take a look at some of the most likely contenders.

- Your vehicle

- Your home

- Your income

- Your business

- Your investments

This seems rather timely to me as spring is when both our auto and home insurance renewals arrive. And like most of you, I complain about the steady increase in premiums and then….pay them. It got me to thinking “Am I spending my premium dollars appropriately?”

Consumer Product Extended Warranty

First off, let’s hope you didn’t select the product coverage that the sales clerk at your local electronics store tried to sell you at check out. This type of consumer insurance is a great profit builder for the corporate entity. Why? Because in most cases, you will never claim on the insurance. You will lose the receipt, forget you have it, or quite frankly never need it. In addition, as a proportion of the cost of the actual product, it’s crazy expensive. And last, but not least, would the loss of the device cause dire, or even serious, financial ruin?

Auto Insurance

Auto policies typically include liability protection. And I would never advise you to drop that critically important piece of your asset protection portfolio. But if I look at that portion alone on my current renewal, the cost runs just over 50% for $2,000,000 of coverage. The balance of my premiums provide coverage to replace my vehicle in some form or another. So I’m paying just over $500 a year to replace a vehicle valued at $38,000. Hmmm. Needless to say, this isn’t my greatest asset. (Note: my rates reflect years of clean driving, multi-policy and age discounts. We won’t discuss what my 18-year old son pays for liability alone!)

Home Insurance

Then there’s our home. Here, a very small portion of the premium goes towards liability coverage. The remaining premium, just under $3,000 covers my “stuff”. So for $3,000 a year (and growing), I have potential coverage of up $2,000,000. Again, not the best value for my money, but the loss of our home and the stuff inside it would definitely have a serious financial consequence for us.

Your Income, Your Business, Your Investments

That leaves us with your income and your investments. For ease of illustration, I’m grouping your business in your investments and trust that in all cases you have sufficient liability coverage.

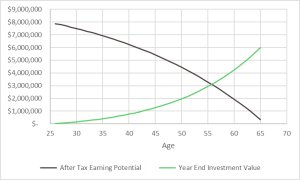

Whether your greatest asset is your income or your investments is really dependent on where you are in your career. For simplicity sake, this chart shows a rough estimate of your lifetime earning potential, based on your current age, and cross referenced with your growing investment portfolio. As you inch closer to retirement, your investments grow while your anticipated lifetime active earnings taper down.

* See assumptions below.

You Are Your Greatest Asset

Without the ability to earn an income, you wouldn’t have any of the material things we’ve spoken of here. It could become impossible to keep your business, and build your investment portfolio. Considering this, how many of your premium dollars are going toward managing the risks placed on your greatest asset – you? Without protecting what you have worked so hard to achieve – your education, your business, your wealth portfolio – what exactly are you protecting?

Asset Protection Portfolio

An asset protection portfolio involves so much more that liability protection. It is critical to ensure that you have reviewed and aligned your premium dollars and behaviour to protect what really matters. Not sure? That’s just one piece of being your personal CFO that I review with you.

Call or email today to start your review.

* Graph assumptions:

Work from age 26 to 65, starting at $120,000 per year, remove 2020 Ontario taxation and self-employed CPP amounts. Maintain these rates into the future. In year two, contribute 18% of previous years pre-tax income to an RRSP. Apply tax credits for RRSP contributions, basic personal amount & Canada Employment amount only. Increase pre-tax salary by 3% per year. Invest 30% of annual after-tax income in monthly installments, earning 5% compounding annual rate of return.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.